401(k) Participants

How Much to Save for Retirement

- How much have you saved already?

- What do you expect to do in retirement?

- What will your fixed expenses be during retirement?

- How much risk can you tolerate in your portfolio?

- How many years do you expect to be retired?

By following these four steps, you can increase your chance of reaching your retirement savings goal.

1. Increase Your Retirement Contributions Each Year

Try to increase your contributions until you are saving at least 12-15% of your paycheck.

2. Use your Salary Raise to Increase Your Contributions

Whenever you get a raise or bonus, consider putting a portion or all of it into your 401(k) plan.

3. Create a Budget and Spend Less

Cut out unnecessary expenses like expensive coffeehouses and move the savings into your 401(k). Reduce and eliminate your credit card debt and commit to paying off your balance each month.

4. Negotiate Services

Sometimes a call to your service providers can result in reduced fees and rates. Try this with your bank, cable TV, insurance carrier, credit card company and other providers that might negotiate fees.

Benefit of Starting Early

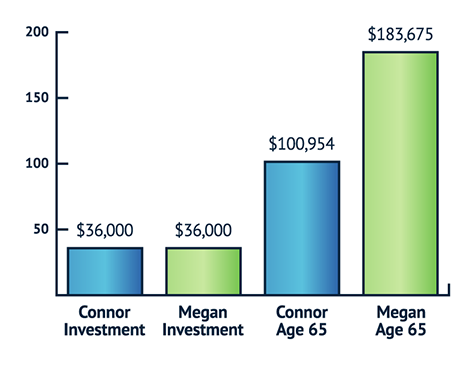

Megan starts to invest at age 25, while Connor waits until age 35. Both invested $100 per month for 30 years. They each invest the same amount of money in total ($36,000). The only difference is that Megan started 10 years earlier and enjoyed a longer timeframe for dollars to compound. At retirement age of 65, see what a difference it made! Megan’s investment grew to $183,675 while Connor’s only reach $100,954.

This example for illustrative purposes only.

How to Prioritize Your Savings

- Contribute to your company’s 401(k) plan up to the match.

- Pay off your credit cards from highest interest rates to lowest.

- Create an emergency fund to cover at least three months of living expenses.

Once you have covered the basics, consider moving on to other priorities:

- Save for the down payment on a home.

- Save for children’s college education.

- Pay down your mortgage.

- Save for major purchases like a car or vacation home.

Retirement Planning Calculators

401(k) Calculator

A 401(k) can be one of your best tools for creating a secure retirement. Calculate how a 401(k) plan can help you build your retirement nest egg.

401(k) Contribution Effects on Paychecks Calculator

Increasing your contributions to your 401(k) is easier than you think. Use this calculator to get an estimate on how increasing your contributions to a 401(k) can affect your paycheck as well as your retirement savings.

How Long Will My Retirement Savings Last Calculator

Use this calculator to see how long your retirement savings will last. This is based on your retirement savings and your inflation adjusted withdrawals.

Retirement Planner Calculator

Do you know what it takes to work towards a secure retirement? Use this calculator to help you create your retirement plan. View your retirement savings balance and your withdrawals for each year until the end of your retirement. Social Security is calculated on a sliding scale based on your income.

Roth (After Tax) vs. Traditional Account (Pre—Tax)

Use this calculator to help determine which type of retirement account may be the best option for your retirement.

Mortgage Calculator

Mortgage Calculator

Use this mortgage calculator to determine your monthly payment and generate an estimated amortization schedule. Quickly see how much interest you could pay and your estimated principal balances.

Credit Cards and Debt Management

Accelerated Debt Payoff Calculator

Consolidating your debt is only half of the battle. You still need a plan to get your debt paid in full. This calculator can show you how to accelerate your debt payoff.

Investment Calculators

Future Value Calculator

This calculator can help you determine the future value of an investment which can include an initial deposit and a stream of periodic deposits.

Present Value Calculator

Use this calculator to determine the present value of a stream of deposits plus a known final future value.

Personal Finance

Budget Analysis Calculator

Managing your monthly budget can be difficult and frustrating. One of the most important aspects of controlling your budget is to determine where your money is going. This calculator helps you do just that.